Extension of various time limits under Direct Tax and Benami laws.

Dear all,

Your association SIMA is in receipt of a mail from IMC Chamber of Commerce & Industry in respect of Extension of various time limits under Direct Tax & Benami laws.

As per the mail, the challenges faced by taxpayers in meeting the statutory and regulatory compliance requirements across sectors due to the outbreak of Novel Corona Virus (COVID-19), the Government brought the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 [the Ordinance] on 31st March 2020 which, inter alia, extended various time limits. To provide further relief to the taxpayers for making various compliances, the Government has issued a Notification on 24th June 2020, the salient features of which are as under:

I. The time for filing of original as well as revised income-tax returns for the FY 2018-19 (AY 2019-20) has been extended to 31st July 2020.

II. The due date for the income tax return for the FY 2019-20 (AY 2020-21) has been extended to 30th November 2020. Hence, the returns of income which are required to be filed by 31st July 2020 and 31st October 2020 can be filed up to 30th November 2020. Consequently, the date for furnishing tax audit report has also been extended to 31st October 2020.

III. In order to provide relief to small and middle-class taxpayers, the date for payment of self-assessment tax in the case of a taxpayer whose self-assessment tax liability is up to Rs. 1 lakh has also been extended to 30th November 2020. However, it is clarified that there will be no extension of date for the payment of self-assessment tax for the taxpayers having self-assessment tax liability exceeding Rs. 1 lakh. In this case, the whole of the self-assessment tax shall be payable by the due dates specified in the Income-tax Act, 1961 (IT Act) and delayed payment would attract interest under section 234A of the IT Act.

IV. The date for making various investment/ payment for claiming deduction under Chapter-VIA-B of the IT Act which includes section 80C (LIC, PPF, NSC etc.), 80D (Mediclaim), 80G (Donations) etc. has also been further extended to 31st July 2020. Hence the investment/ payment can be made up to 31st July 2020 for claiming the deduction under these sections for FY 2019-20......FOR MORE DETAILS PLEASE CLICK HERE.

Thanking you,

With regards,

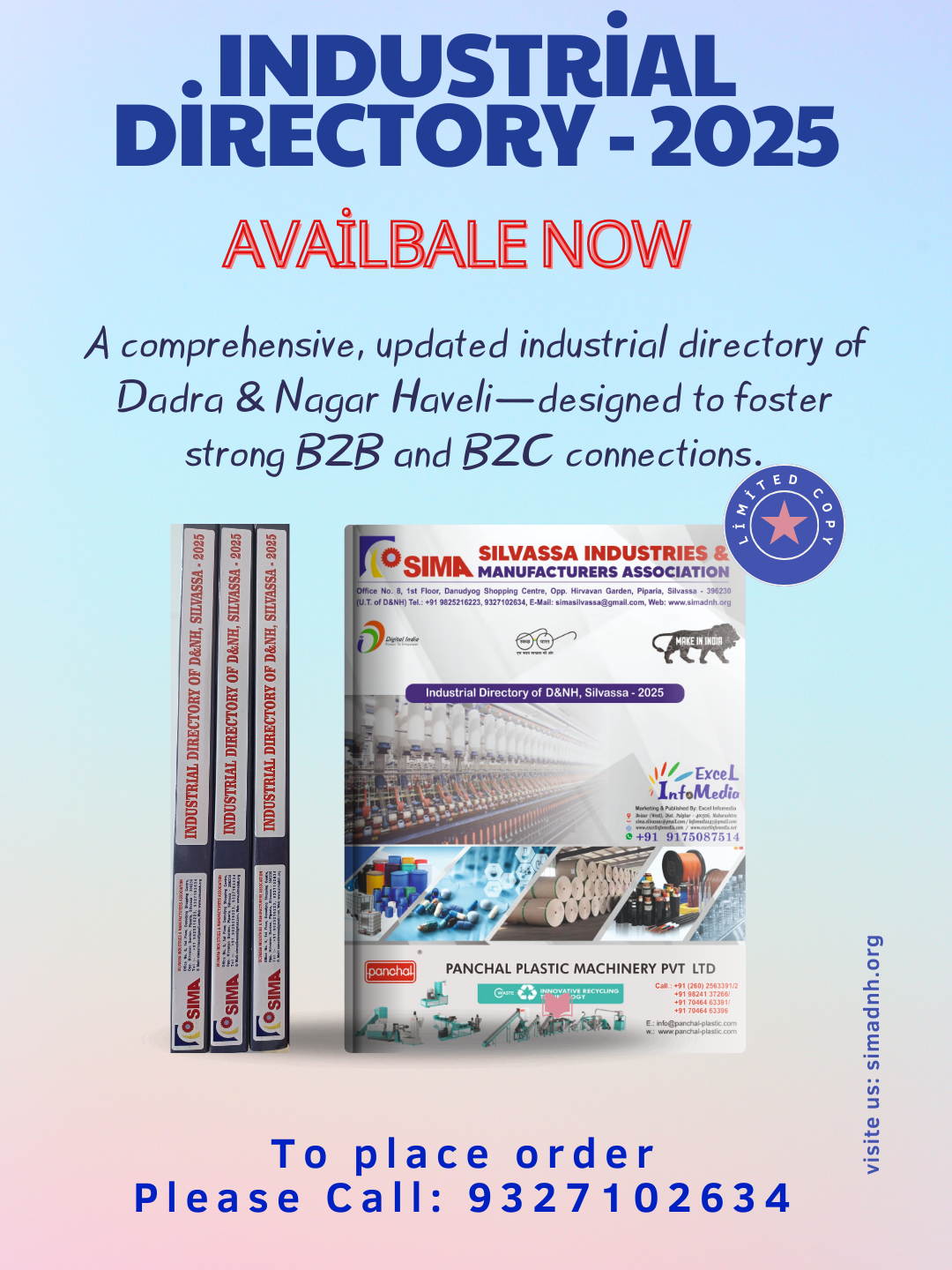

For Silvassa Industries & Manufacturers Association

Narendra Trivedi

Secretary

Other News by SIMA

- SIMA NEW MEMBER - ASIA PACIFIC MARBLES LIMITED

- Online Seminar on Decoding Govt. Stimulus package for MSMEs.

- Employees Deposit Linked Insurance(Amendment) Scheme

- Wishing you and your family a very Happy and Prosperous Diwali..

- Circular issued by the Department of Industries, U.T Administration of D&NH and DD.