Various articles on GST published in leading newspapers Economic Times and Business Standard

Dear all,

Your association is forwarding herewith the articles on GST published on various leading news publishers i.e. Economic Times and Business Standard.

Economic Times: 24/04/2019

Non-filers of GST returns for 2 months to be barred from generating e-way bills from June 21

Non-filers of GST returns for two straight months will be barred from generating e-way bills for transporting goods effective June 21, the finance ministry said. Businesses under GST composition scheme, however, will be barred from generating e-way bill if they fail to file tax returns for two consecutive filing periods, which is six months… TO READ THE FULL ARTICLE PLEASE CLICK HERE.

Economic Times: 25/04/2019

Finance Ministry brings in changes in e-way bill system to check GST evasion

The Finance Ministry has introduced changes in the e-way bill system, including auto calculation of distance based on PIN codes for generation of e-way bill and blocking generation of multiple bills on one invoice, as it seeks to crack down on GST evaders.

Touted as an anti-evasion tool, the electronic way or e-way bill was rolled out on April 1, 2018, for moving goods worth over Rs 50,000 from one state to another. The same for intra or within the state movement was rolled out in a phased manner from April 15… TO READ THE FULL ARTICLE PLEASE CLICK HERE.

Business Standard: 25/04/2019

1. GST Council gives firms more flexibility on use of input tax credit

Any company would now be eligible to use credit available against paid integrated GST (IGST) to set off tax liabilities of state GST (SGST) and central GST (CGST) in any proportion and in any order.

In yet another simplification, the Goods and Services Tax (GST) Council has added flexibility into the way a company can utilise the available input tax credit. Any company would now be eligible to use credit available against paid integrated GST (IGST) to set off tax liabilities of state GST (SGST) and central GST (CGST) in any proportion and in any order, the GST Council said in a circular sent to field formations on Tuesday…. TO READ THE FULL ARTICLE PLEASE CLICK HERE

This is for your kind information.

Thanking you,

With regards,

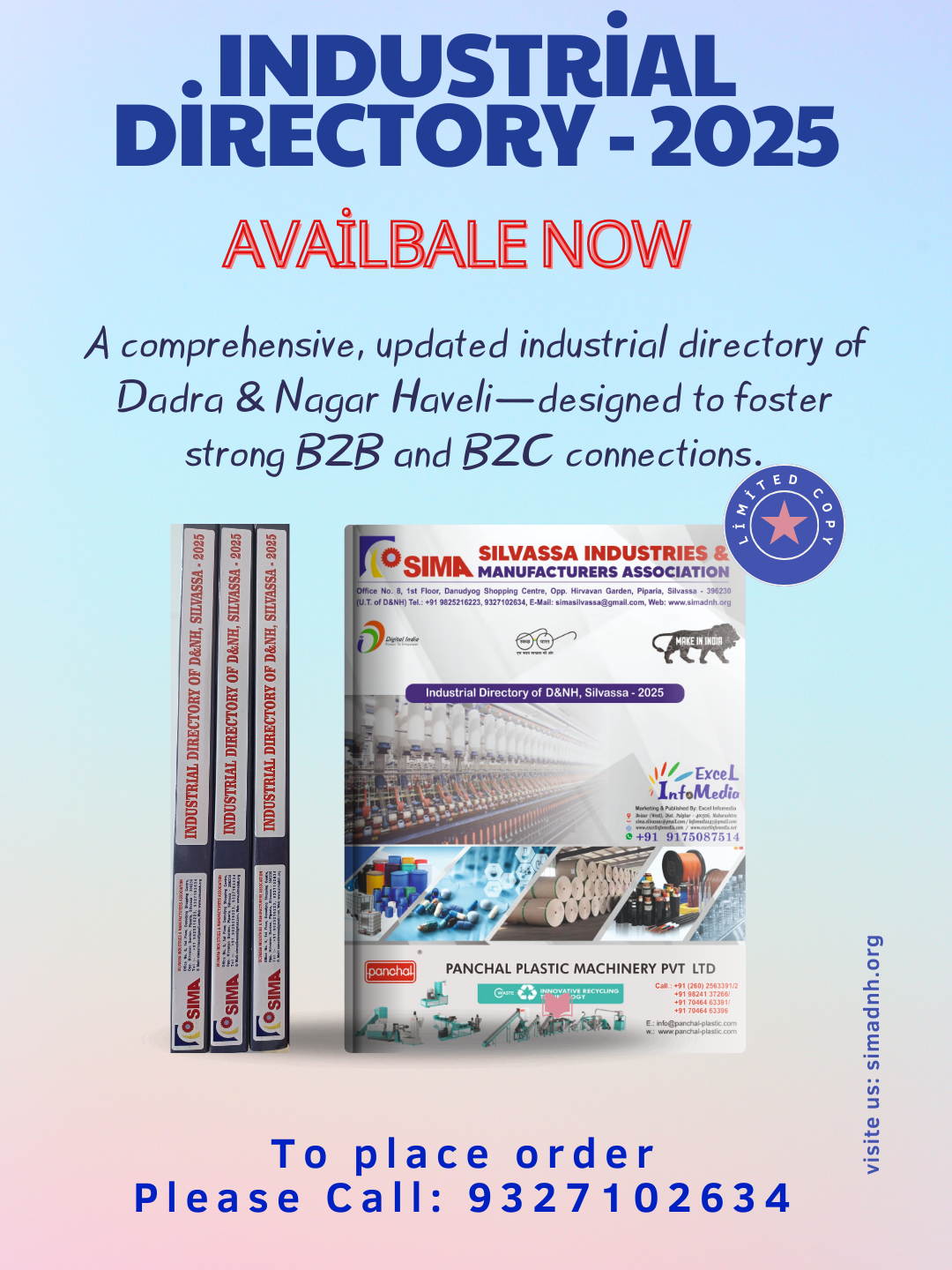

For Silvassa Industries & Manufacturers Association,

Narendra Trivedi,

Secretary

Other News by SIMA

- SIMA NEW MEMBER - ASIA PACIFIC MARBLES LIMITED

- Online Seminar on Decoding Govt. Stimulus package for MSMEs.

- Important order passed by Hon'ble High Court, Delhi in respect of Delay in VAT refund.

- All India Plastics Associations has called an Emergency Meeting on 9th December 2019 (Monday).

- Circular regarding Recyclers and Refurbishers of Battery.