Circular issued by Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, GOI.

Dear all,

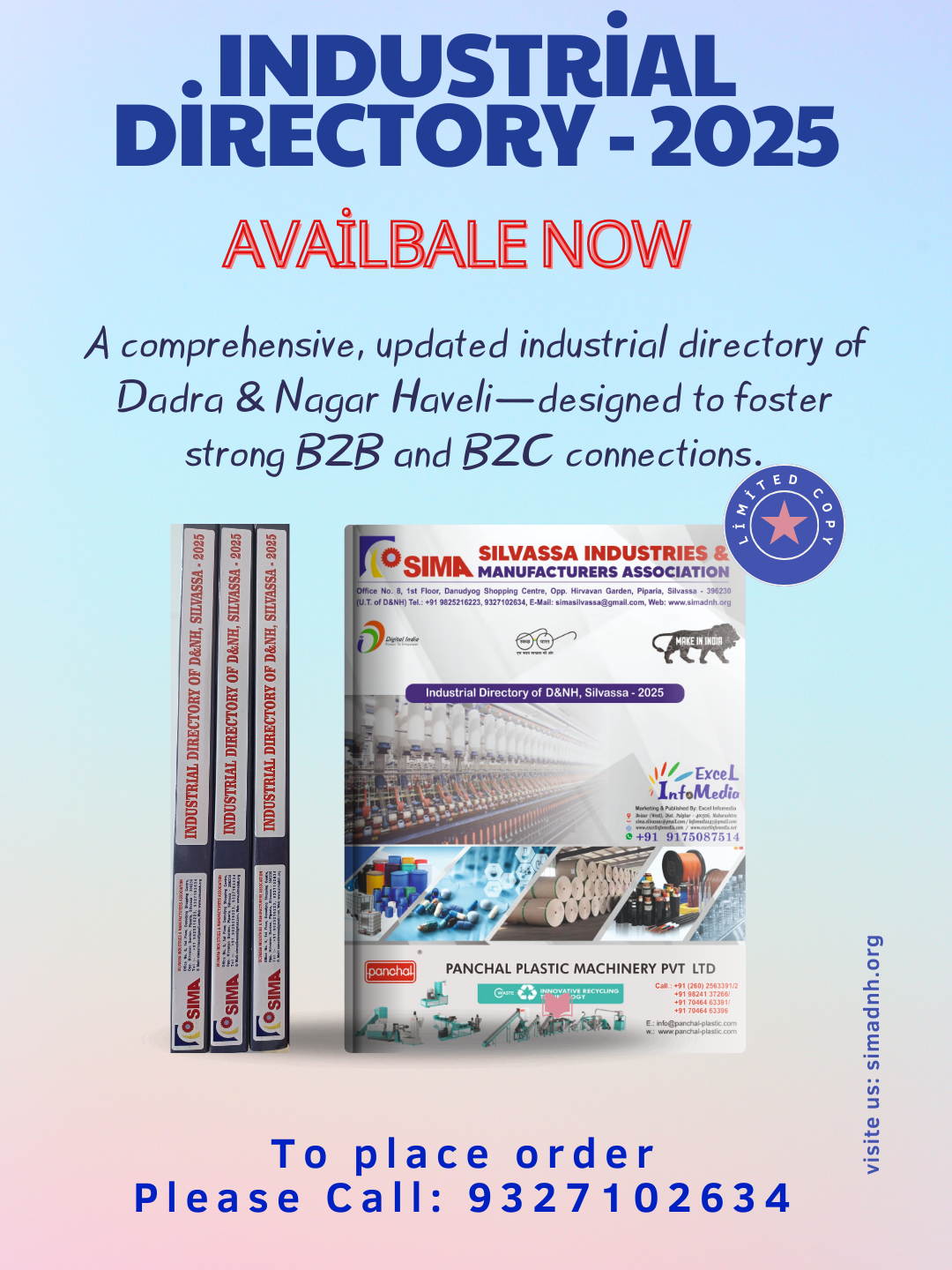

Your association SIMA is forwarding herewith a Circular No. 32/2019 dated 30.12.2019 issued by Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, Government of India regarding Clarifications in respect of prescribed electronic modes under section 269SU of the Income-tax Act, 1961.

Vide Circular, in furtherance to the declared policy objective of the Government to encourage the digital economy and move towards a less-cash economy, a new provision namely Section 269SU was inserted in the Income-tax Act,1961 (''the Act''), vide the Finance (No. 2) Act 2019 ('' The Finance Act''), which provides that every person having a business turnover more than Rs. 50 Crore (''specified person'') shall mandatorily provide facilities for accepting payments through prescribed electronic modes......TO VIEW THE FULL CIRCULAR PLEASE CLICK HERE.

Thanking you,

With regards,

For Silvassa Industries & Manufacturers Association

Narendra Trivedi

Secretary